| Equity Returns + Low Volatility = Shriram Equity & Debt Opportunities Fund |

|---|

|

An open end equity oriented asset allocation fund. The scheme automatically spreads your money across a diversified portfolio of stocks and bonds to provide investor the best of both worlds.

The investment objective of the Scheme would be to generate long term Capital appreciation and current income with reduced volatility by investing in a judicious mix of a diversified portfolio of equity and equity related investments, debt and money market instruments.

The scheme is suitable for investors with an objective to build long term wealth with a time horizon of 3 to 5 years.

The scheme shall invest a minimum of 65% and a maximum of 85% in equity and equity related instruments. The balance would stay put in debt securities including money market instruments between 35% to 15%.

The Fund follows a robust investment process that encapsulates profitability, business attractiveness, competitive positioning, balance sheet strength, management track record, corporate governance, valuations etc. The investment style is a combination of top down and bottom up approach. For instance, we use the top down approach to focus on a particular industry which we believe is likely to outperform. Once we decide on a sector, we use the bottom up approach to decide the company that is likely to give better value for money.

Ms. Gargi Bhattacharyya Banerjee serves as the Fund Manager of Shriram Mutual Fund having an experience of over 16 years in her professional career. She received her Master of Business Management with specialization in Finance and Bachelor of Science with Economics (H) from University of Calcutta.

The scheme has so far declared 24.50% dividend since inception under dividend plan. Performance under growth plan regular – December quarter 2015

| Period | Scheme | BenchMark |

| Calendar year 2014 | 26.84 % | 26.32 % |

| Calendar year 2015 | -0.03 % | -0.25 % |

| Since Inception - CAGR | 12.97 % | 12.34 % |

CAGR refers to compounded annualized growth return

Minimum investment amount is Rs 5000.00 and therein multiples of Re.1. Under systematic investment plan, the minimum amount is Rs 1000.

There is no entry load. Exit load is applicable @1% if exited before one year from the date of investment/allotment

As per the current tax law (2015-16), Dividends are tax free in the hands of the investor. No Long term capital gains tax if units are held for a period more than one year from the date of investment/allotment of units.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME

RELATED DOCUMENTS CAREFULLY. With regard to taxation; Investors are advised

to consult their tax consultants to know the consequences of tax, if any. Income

Tax benefits to the mutual fund & to the unit-holder are in accordance with

prevailing tax law. The investor shall be solely responsible for any action taken

based on this document. Shriram Mutual Fund, Shriram Asset Management Co.Ltd., Shriram

Mutual Fund Trustee Ltd., and it's associates shall not be liable in any manner

for the consequences of such action taken by the investor.

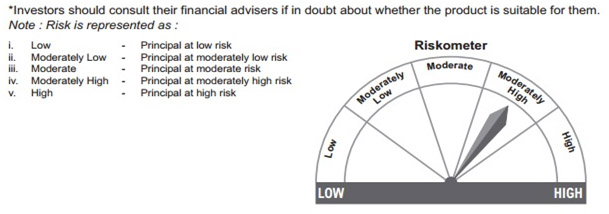

Risk Factors: All Investments in mutual funds and securities are subject

to market risks and the NAV of the Scheme may go up or down depending upon the factors

and forces affecting the securities market. There can be no assurance that Scheme's

investment objective will be achieved. The past performance of the Mutual Fund is

not indicative of the future performance of the Scheme. The scheme inception date

was 29th November 2013.The Sponsor is not responsible or liable for any loss resulting

out of the operation of the Scheme beyond the initial contribution of Rs.1 Lakh

made towards setting up the Mutual Fund. Shriram Equity and Debt Opportunities Fund

is only the name of the Scheme and does not in any manner indicate the quality of

the Scheme or it's future prospects or returns. There is no guarantee or assurance

as to any return on investment of the unit holders. The investments made by the

Scheme are subject to external risks on transfer, pricing, trading volumes, settlement

risks, etc. of securities. Please refer to the Offer Document/Statement of Additional

Information/Key Information Memorandum of the scheme before investing.